|

|

Mortgages

What

Is a Mortgage?

A mortgage is a loan secured by real estate. In other words, in return

for the funds necessary to purchase a home, a lender, gets your promise

to pay back the funds over a certain period at a certain cost.

Backing your promise to repay is the property. Should you default, or

stop paying, the loan, the lender would take over ownership of that

property. Typically, the repayment of a mortgage occurs through monthly

payments.

What

Does My Mortgage Payment Include?

Usually, your monthly mortgage

payment is made up of four parts: principal, interest, taxes and

insurance (PITI), but it can also include maintenance expenses, such

as condominium homeowners' association dues. The principal is the amount

in your monthly payment that reduces the original amount borrowed.

Over

the life of a standard mortgage loan, the entire original amount borrowed

is generally scheduled to be fully paid off, or amortized. The interest

rate is the fee charged to borrow the outstanding balance for the past

month. In addition, a monthly amount may be collected and held in a

separate escrow account to cover property taxes, homeowner's insurance

and mortgage insurance. Your lender uses the money in the escrow account

to pay your tax and insurance bills, as they come due.

How

Do I Qualify For a Mortgage?

In general, all lenders use the same four basic standards to approve

applicants for a mortgage. Different mortgage products have varying

guidelines within those standards. The

lender looks at your income,

credit history, assets and property information.

What

types of loans exist?

Fixed-rate

mortgages.

The interest rate remains fixed for the life of the loan.

- Offer

predictable monthly payments of principal and interest throughout

the life of the loan.

- Provide

protection from rising rates. No matter how high market rates go up,

your interest rate stays the same.

- Generally

well-suited to borrowers who plan to stay in their homes for a long

period of time, have a fixed or slowly-increasing income, and have

a lower tolerance for financial risk.

Adjustable-rate

mortgages.

The interest rate adjusts periodically to reflect market conditions

on pre-determined dates.

- The

initial introductory period usually offers a lower rate (relative

to fixed-rate mortgages), after which the rate adjusts periodically,

based on a market index.

- Borrowers

are protected from steep increases in rates through annual and lifetime

adjustment caps.

- The

initial rate can be locked in for different periods such as one, three,

five, seven, or ten years. Typically, the rate readjusts annually

after the introductory period.

- Because

of the introductory period's lower rate, some

borrowers may be eligible for a larger loan amount with an ARM than

with a fixed-rate mortgage.

- May

be more appropriate for borrowers who may want to sell or refinance

early, can afford to make larger monthly payments after the rate adjusts,

or are looking to buy a home when interest rates are relatively high.

Jumbo

loans.

These are loans that exceed a specified size (conforming loan amounts). In

2009, jumbo loans on single-family homes exceed $417,000.

- Rates

are generally higher on jumbo loans than on smaller comparable loans.

FHA

Loan. The Federal Housing Administration (FHA) insures a wide variety

of mortgages. These loans are designed to meet the needs of homebuyers

with low or moderate incomes and feature:

- Low

down payment requirements

- Loan

limits based on geographic locations Generally more liberal qualifying

guidelines

- Use

of gift funds for down payment and/or closing costs.

VA

Loans.

The Department of Veterans Affairs (formerly the Veterans Administration)

guarantees mortgages for qualified veterans and active-duty military

personnel and their spouses who are first- or second-time homebuyers.

VA loans feature:

- Low

or no down payment requirements

- A

wide range of rate, term, and cost options

- Flexible

qualifying guidelines

- Use

of gift funds for closing costs

Alternative

financing.

These programs are designed for borrowers with less-than-perfect credit

histories, excessive debt, or previous bankruptcy, foreclosure or tax

delinquency.

No

Documentation Loans.

Designed for borrowers who are self-employed, on commission or whose

financial situation may be difficult to document .These loans allow borrowers

to apply for a loan based on their credit history and stated income. Although these were readily available only a few short years ago, today it is rare to find such products. However, we do have opportunities for investors that are looking to purchase "business" designated properties. For homes you are looking to purchase quickly, remodel and sell. Although rates on such mortgages are always high and expensive, this allows many investors to get in and out with little fan fair. Before you consider such an option, make sure you exhaust all other possibilites. Working with a Plum Tree Consultant will insure you make a great decision for your financial situation.

For

more information contact us via email, or

call 503-493-2353.

|

|

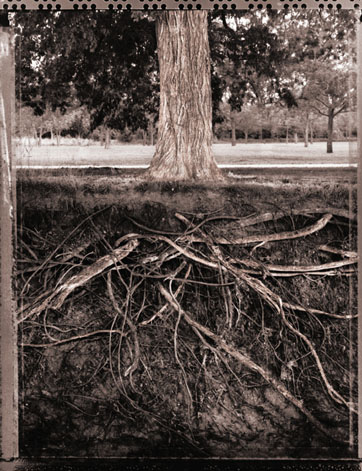

We

help clients see the whole picture.

|

|