|

|

Understanding your Credit

How to Establish, Use, and Protect Your Credit

Good credit is valuable. Having the ability to borrow funds allows us to buy things we would otherwise have to save for years to afford: homes, cars, a college education. Credit is an important financial tool, but it can also be dangerous, leading people into debt far beyond their ability to repay. That is why learning how to use credit wisely is one of the most valuable financial skills anyone can learn.

Your Credit Report

Most people finance their homes with mortgages and pay for their cars with loans. Young people often obtain loans to pay for college. And, of course, lots of people make purchases with credit cards.

You can't expect to receive credit as a matter of course, however. You must apply for it. And just as you would hesitate to lend money to a stranger, banks, retailers, or finance companies will not grant you credit without knowing something about you.

It used to be that a retailer or bank would have to call each creditor you listed on an application form before they would decide to extend credit to you. Today, they rely on credit reports, so it's important for you to know what is in yours.

- What Is a Credit Report?

- Where Do Credit Reports Come from?

- What is a Credit Rating?

- Who Is Allowed to See Your Credit Report?

- What Type of Information Is on Your Credit Report?

- Where Do the Consumer Reporting Agencies Get Their Information?

- Who Decides whether or not to Grant You a Loan?

- Why Should You Obtain a Copy of Your Credit Report?

- How Do Errors in Reports Happen?

- How Do You Correct an Error on Your Credit Report?

- What if the Consumer Reporting Agency Stands by Its Report?

- What Should You Do if You Are Denied Credit because of Something in Your Credit Report?

- How Long Does Information Stay on Your Credit Report?

How Do You Get a Copy of Your Credit Report?

Your Credit Rights

Credit is valuable. The importance of how much credit you have and how you use it goes far beyond shopping. Whether you have good or poor credit can affect where you live and even where you work, because your credit record may be considered by prospective employers. That is why you need to understand how credit is awarded or denied and what you can do if you are treated unfairly. The major laws that regulate credit are outlined in this brochure.

- Fair Credit Reporting Act

- Equal Credit Opportunity Act

- Fair Credit Billing Act

- Fair Debt Collection Practices Act

|

|

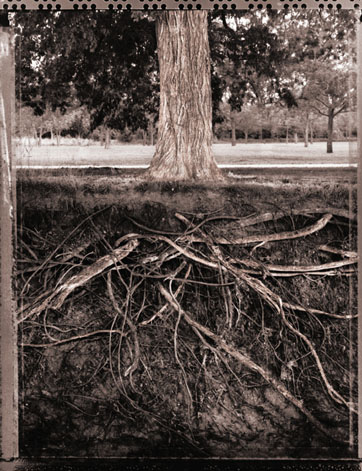

We

help clients see the whole picture.

|

|